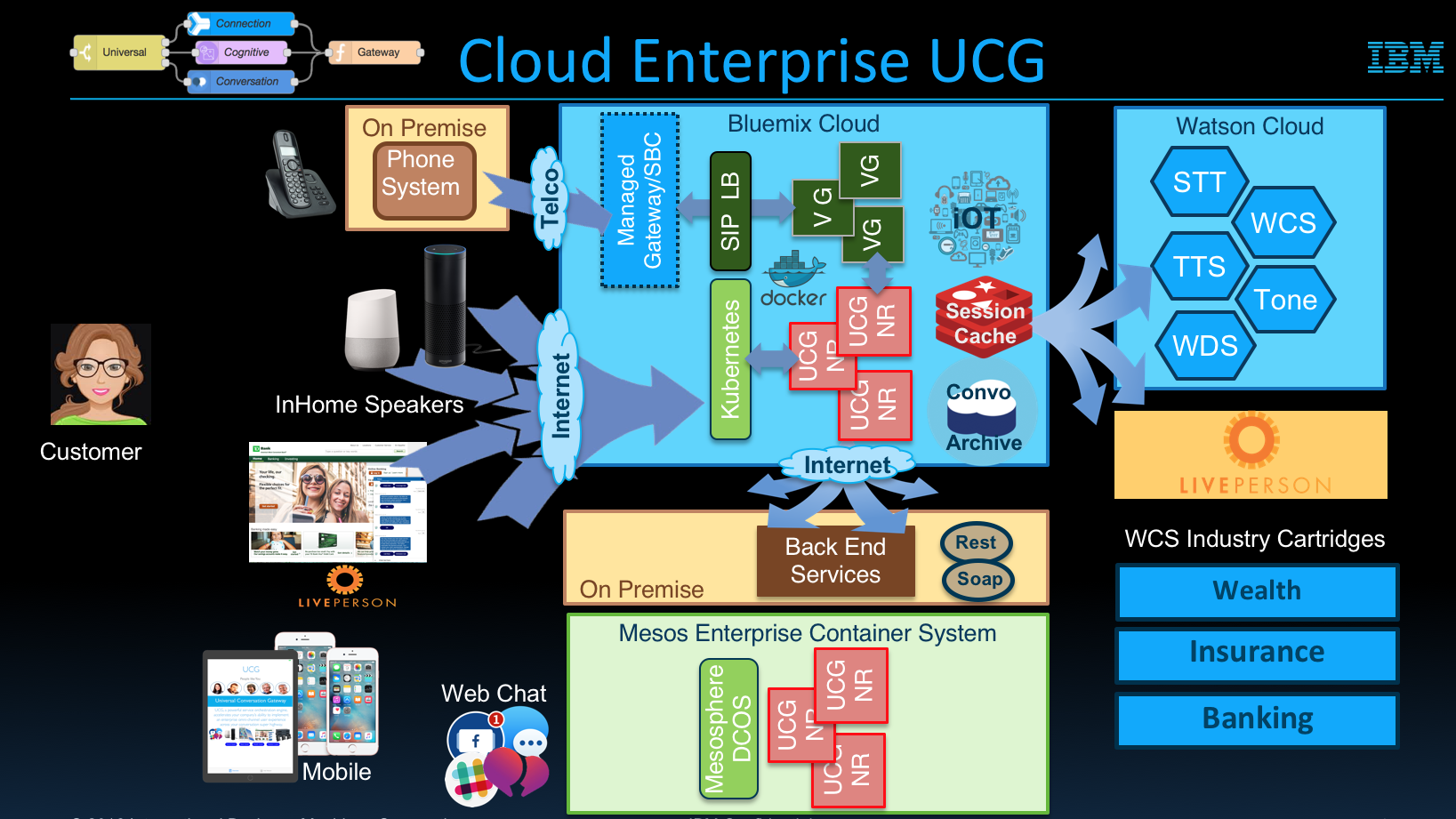

While at IBM, Dennis was tapped to improve customer care at the bank on two fronts, virtual assistance using Watson to improve customer/agent satisfaction and to empower agents with information to become more effective with solving and educating customers. He recognized that IBM did not have a product, but a bunch of apis. Taking his vast knowledge of SOA(service orchestration architecture), ESB, and integration experience, he developed the Universal Conversation/Cognitive Gateway, UCG, which managed the workflow of the AI and NLU services via a SAAS platform that was implemented at the bank.

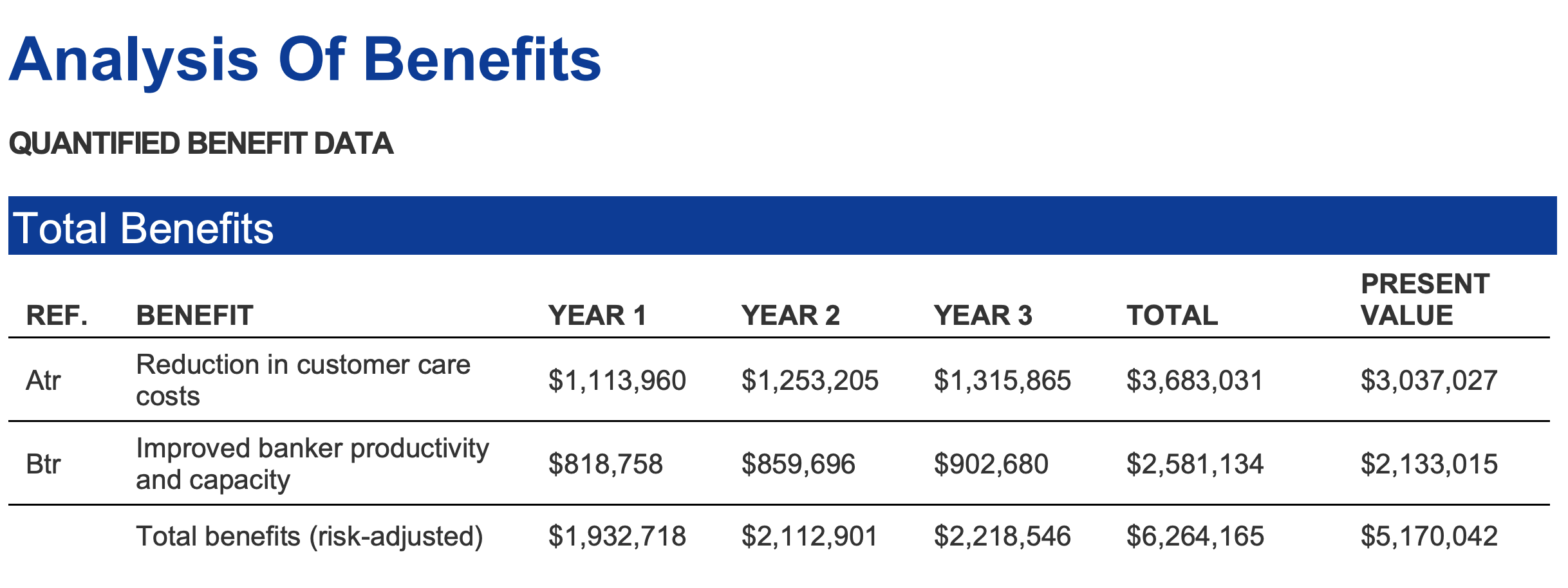

Regions Bank Benefits:

Managed 331,000 customer care calls entirely within Watson in first year of use; projecting slightly over a million customer care calls handled within Watson over three years. By building virtual agents and conversations using the Watson platform for three common customer care inquiries, Regions enabled self-service customer care while fully automating and handling inquiries from end to end using virtual agents. By the third year of the analysis, Watson is projected to help Regions manage over 350,000 customer care calls entirely within Watson annually. The resulting risk-adjusted three-year savings from call deflections total a PV of just over $3 million. This benefit effectively expanding the customer care function’s capacity by 28 FTE bankers.

Reduced average call handle times by over 57,000 hours annually. Using Watson for long- and short-tail tagging using Watson Explorer, Regions built out a banker assist solution to expedite research for problem resolution and improve customer care knowledge management. As a result, bankers and agents have seen a 10% reduction in the 4.5 minutes they spent researching customer issues on an average call, saving an average of 27 seconds per call.

Ability to build once and redeploy cognitive solutions in an omnichannel way. At the time of the interview, approximately 90% of Region’s customer care requests came through the phone channel. With that said, through its investments in Watson and other IBM technologies, Regions maintains the flexibility to enable virtual banker conversations with consumers across a variety of digital channels e.g., click-to-chat, short message service (SMS), mobile apps — as the preferences of its customer base change over time. While this analysis is based exclusively on the business impacts of Watson on customer care requests through the phone channel, the conversations built in Watson can be deployed in an omnichannel way, allowing Regions to manage even more customer interactions using cognitive solutions without incurring massive incremental development costs.

Making customer service a differentiator. A Forrester survey of global customer service business and technology decision makers found that forward-looking customer service organizations seek to differentiate through customer service. The survey found that 52% believe that improving differentiation is a high or critical priority while 63% identified addressing rising customer expectations as a pivotal priority. In the face of these trends, Regions saw customer care center transformation and its cognitive center of excellence (CoE) as critical tools in improving their customer experience. Anecdotally, Regions was beginning to see fruits from its investments; Regions saw an uptick in its referral rate following its adoption of cognitive customer care solutions.

Implementation of new cognitive use cases across the business. Regions built a CoE to enable new use cases for Watson both within the customer care function and across the business. While Regions initially applied its cognitive self-service virtual banker solution to phone-based fee waiving, online banking FAQs requests, and credential resets, it plans to roll out credit card activation and ordering, profile updates, transaction disputes, and other virtual customer care conversations over time. Regions also expressed interest in rolling out the cognitive banker assist capabilities outside of the customer care center into the branches and other lines of business. In both scenarios, the number of call deflections and the agent productivity gains would likely rise significantly.

Power Glove for Customer Care

UCG enabled Region’s development staff to externalize all workflows and execute key back office requests for customer information that personalized conversations to improve the customer’s experience

Orchestration over all external integrations

UCG became the conversational hub that the virtual self service banker and cognitive bank assist utilized to execute all external calls to all SAAS resources necessary to educate the machine learning modules and fill all conversational and analytical flows for the bank.